How to pay duties and taxes for imported goods

…

If you are planning to have future shipments sent to you by courier from outside Canada, you do have the option of refusing the accounting services offered by the company, choosing instead to clear the goods yourself through your local CBSA office. If you choose to do this, you will not incur any brokerage fees. The two options available to you are the following:

1. Prior to receiving your shipment, you can contact the courier company and inform them of your wish to self-clear any shipments that are addressed to you and on which brokerage fees are applicable. The company will explain their procedures to you.

2. As an alternative, when a casual shipment is delivered to you, you can refuse delivery and advise the courier company of your intention to self-clear directly with the CBSA. In this case, please ensure that you take note of the unique shipment identifier number on the package, as the shipment will be returned to the courier’s warehouse.

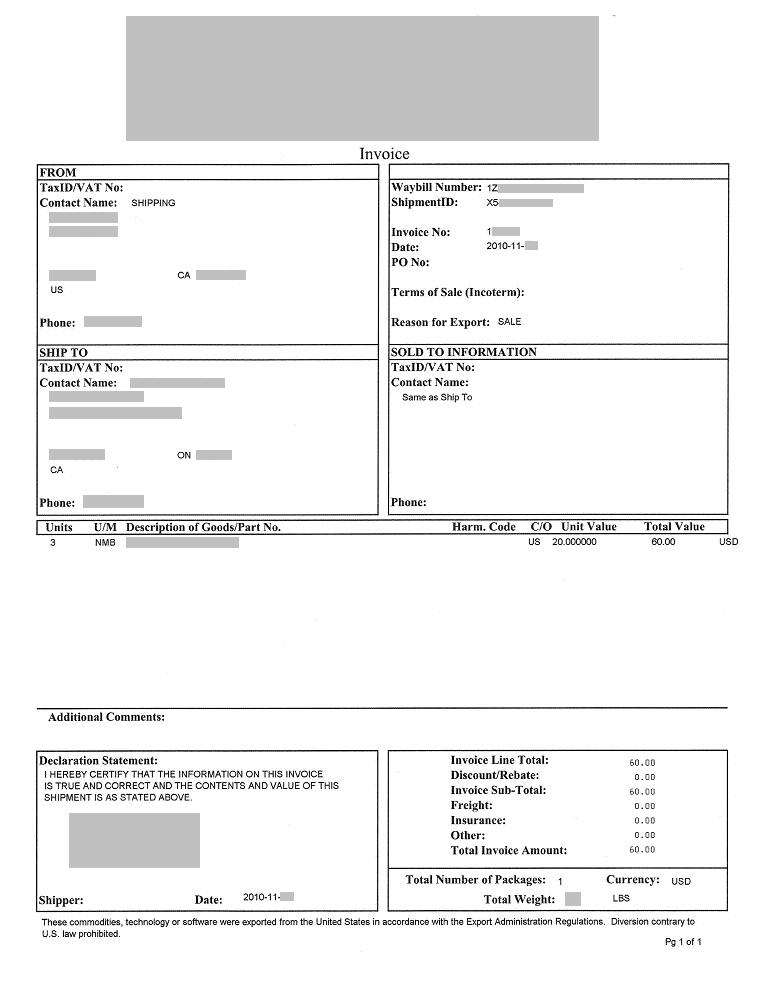

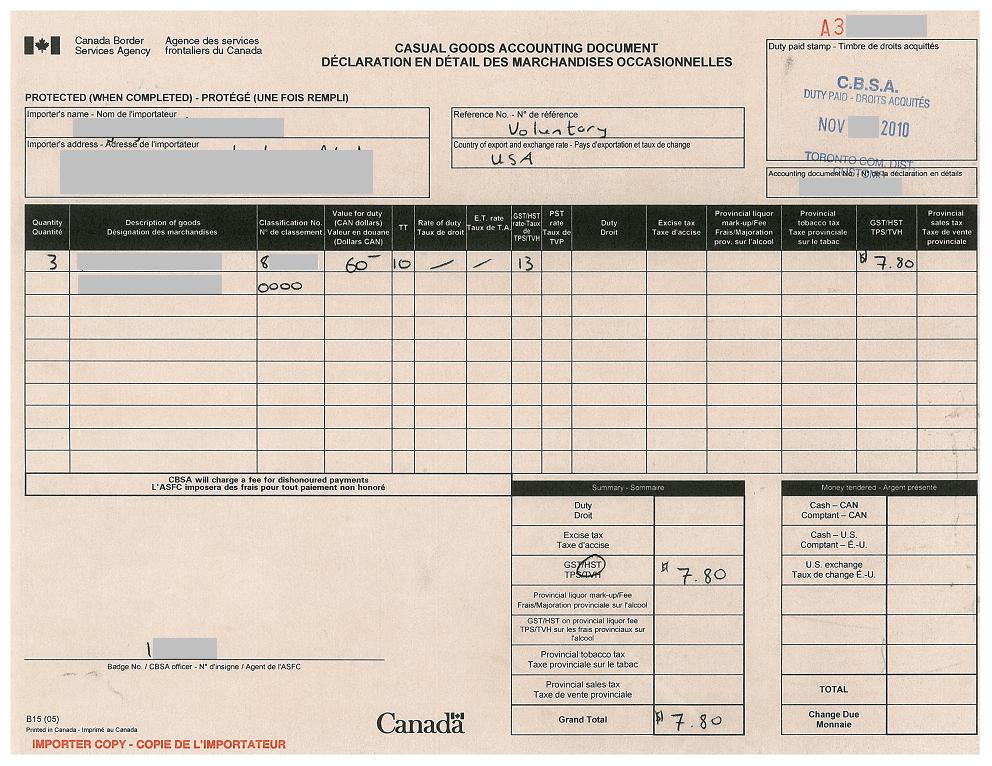

With both options, you will need to visit your local CBSA office and provide them with specific details, including the courier’s name, the unique shipment identifier number, a description of the goods and their value so that the CBSA can correctly assess the goods. This information is usually indicated on the shipment’s invoice, which will be provided to you by the courier company. When you have paid the applicable duties and/or taxes to the CBSA, you will be given an official receipt indicating that the goods have been accounted for. You will need to present this receipt to the courier’s warehouse where your shipment is stored, in order for the courier to release your shipment to you.

Thank you for contacting the CBSA.

Internet: www.cbsa-asfc.gc.ca (http://www.cbsa-asfc.gc.ca/)

Canada Border Services Agency

Ottawa, Ontario

K1A 0L8

Government of Canada – Gouvernement du Canada

From: http://trueler.com/2010/09/13/ups-brokerage-fees-total-scam-fraud-cheating-avoid-it/